Gene Hackman had a will, but the public may never find out who inherits his $80M fortune

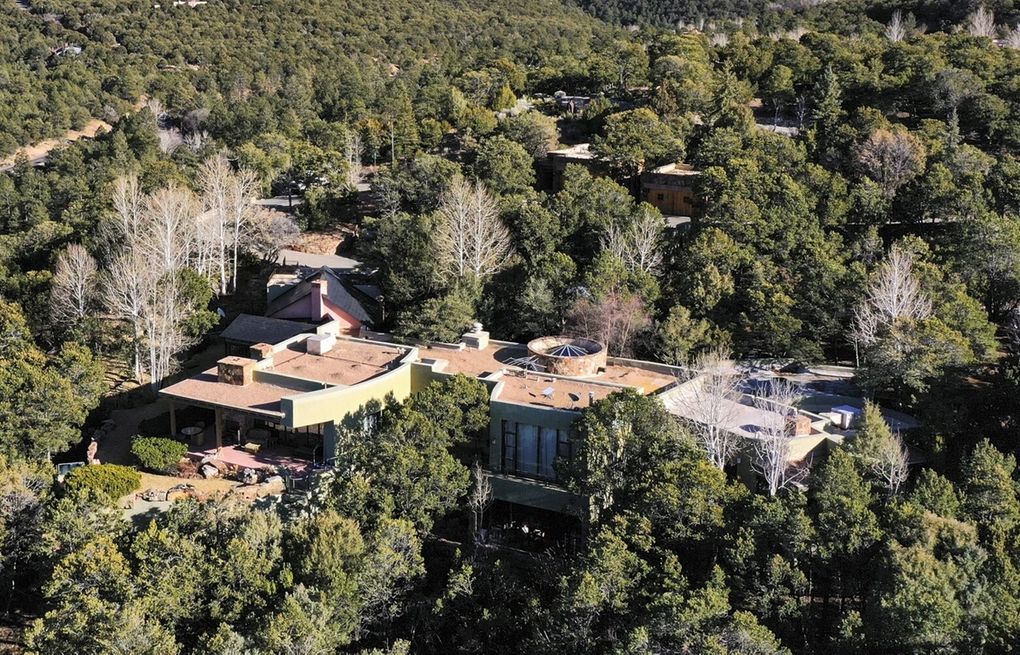

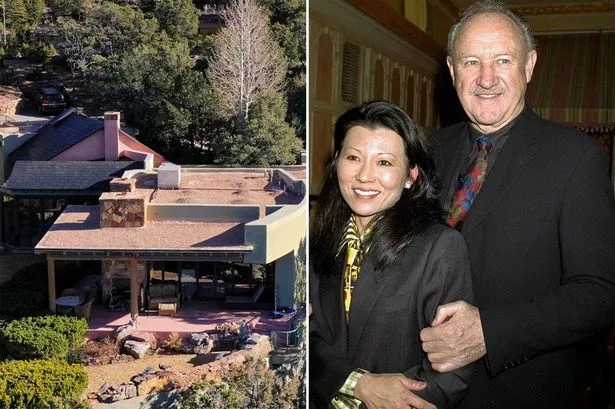

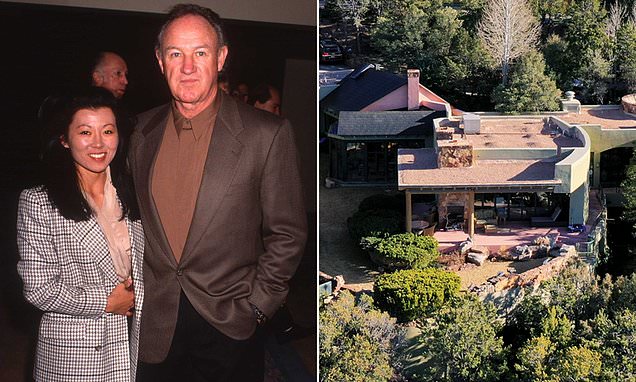

Gene Hackman, a legendary actor known for his powerful performances in films like “The French Connection” and “Unforgiven,” passed away on February 26, 2025, at the age of 95. His unexpected death, only a week after the loss of his wife, Betsy Arakawa, has sparked widespread interest and speculation regarding the fate of his considerable estate, which is estimated to be around $80 million. The intricacies of Hackman’s financial arrangements and the mystery surrounding his will and potential heirs have captivated the public imagination.

Unveiling the Mysteries of Hackman’s Will

Despite the public’s keen interest, the details of Gene Hackman’s will remain undisclosed. It has been indicated that both Hackman and Arakawa had established a trust to manage his assets after their demise. While the will itself is effective upon a person’s death, the trust can often provide more flexibility, managing the estate both during one’s lifetime and beyond. This distinction plays a crucial role in understanding how Hackman’s fortune is set to be handled.

With the passing of his wife, who was named as a trustee in the trust document, the management of Hackman’s estate has entered into a state of uncertainty. Given the complexity of estate law, a new trustee may need to be appointed, but the details of who that might be are still confidential. The absence of publicly available information fuels speculation about who will ultimately inherit Hackman’s extensive wealth.

Elements of Gene Hackman’s Estate Planning

Hackman and Arakawa’s estate planning, initiated around 2005, appears to have included common yet effective strategies such as creating a living trust combined with a pour-over will. This method, designed to ensure a smooth transition of assets, allows any property owned by an individual at the time of their death to be transferred into the trust, streamlining the estate management process and keeping it out of the lengthy public probate process.

- Living Trust: This document stipulates who receives the estate while maintaining privacy and reducing probate complications.

- Pour-Over Will: This serves as a backup, ensuring that any assets not placed into the trust during the individual’s life are still included upon their death.

The Beneficiaries and Future Implications

While specific details about beneficiaries remain undisclosed, there have been mentions of Hackman’s children from his first marriage potentially being involved in the distribution of his estate. This creates an air of uncertainty, further complicated by the fact that Betsy Arakawa’s will specified that her assets were to benefit Hackman’s trust only should he survive her by a specified time frame. Since Hackman passed before this condition was fulfilled, her estate will not bolster his trust.

This situation presents a plethora of considerations regarding beneficiary designations, highlighting the importance of having comprehensive and forward-thinking estate plans. The dynamics of blended families and differing interests can lead to complicated scenarios when distributing assets, making prudent planning essential for a smooth process.

Key Takeaways from Hackman’s Estate Planning

The circumstances surrounding Gene Hackman’s estate offer vital lessons in effective estate planning:

- Privacy Matters: Establishing a living trust not only secures personal details but can also minimize administrative hassles during estate management.

- Planning for Contingencies: With unforeseen events such as the untimely death of beneficiaries or trustees, it’s critical to identify contingent beneficiaries and alternative trustees within estate documents.

- Careful Consideration of Distribution: For families, especially those with stepchildren, making thoughtful, clear, and fair decisions about distribution can prevent discord and maintain familial harmony.

In unraveling the complexities surrounding Gene Hackman’s estate, it becomes evident that planning for the future is paramount. His case highlights the significance of thoughtful estate management and reinforces the need for individuals to create comprehensive estate plans tailored to their unique family dynamics. If you’re looking to organize your estate or have questions about the process, consult a professional who can guide you through the nuances of estate planning to ensure your legacy is protected.