Gene Hackman had a will, but the public may never find out who inherits his $80M fortune

Understanding Gene Hackman’s Estate Planning and the Mystery of His $80M Fortune

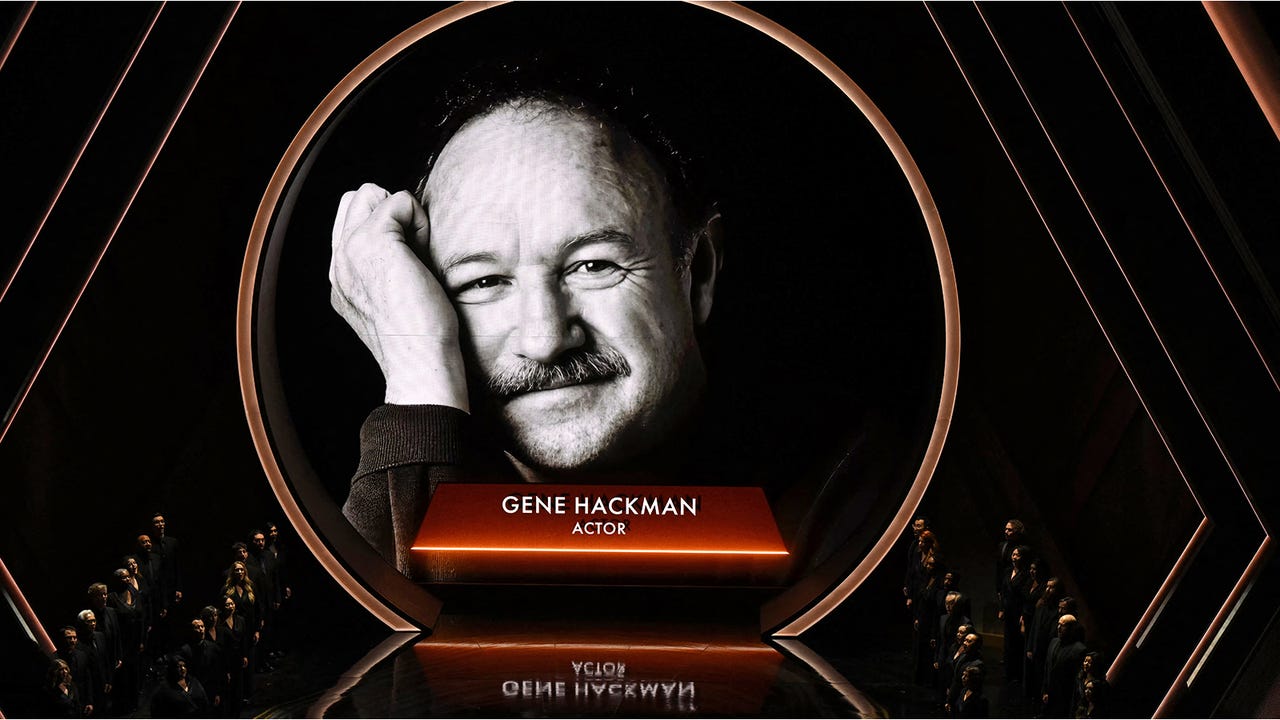

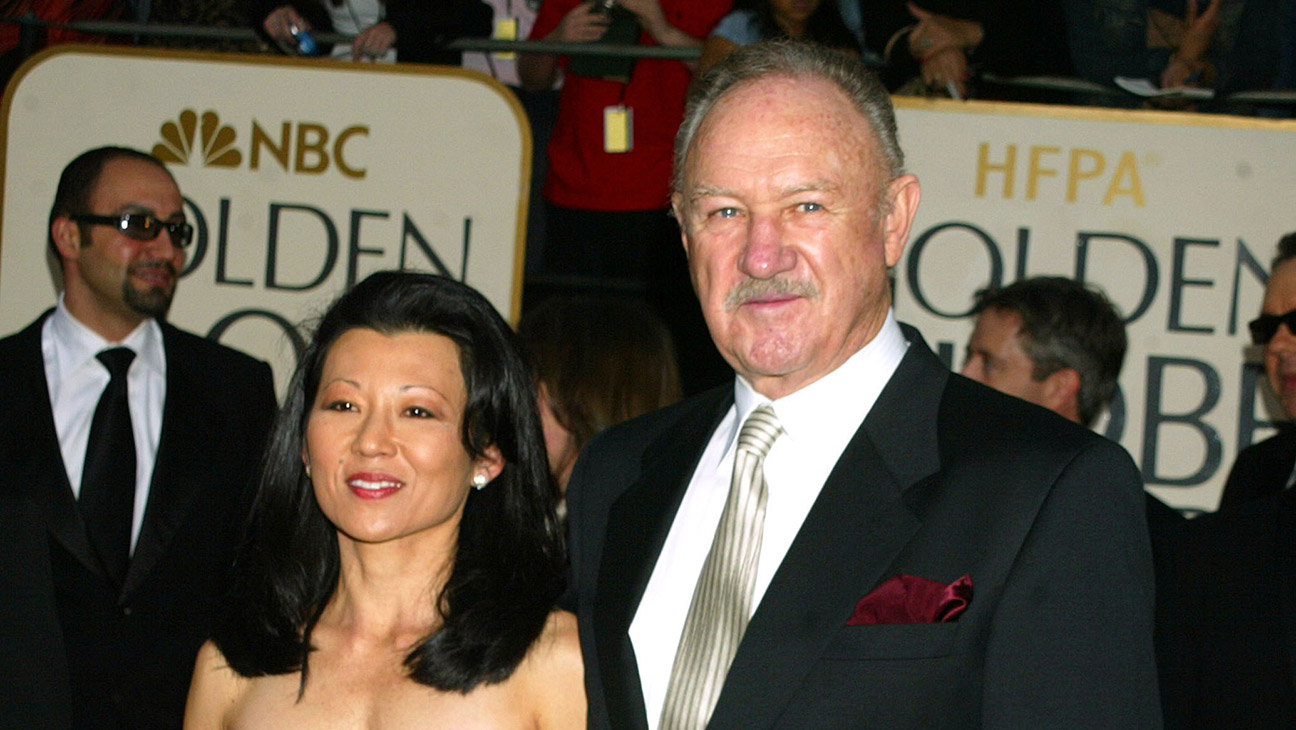

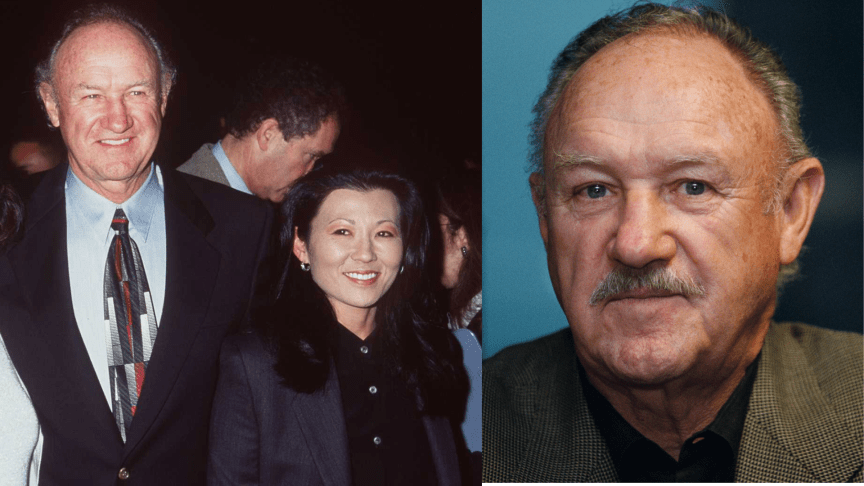

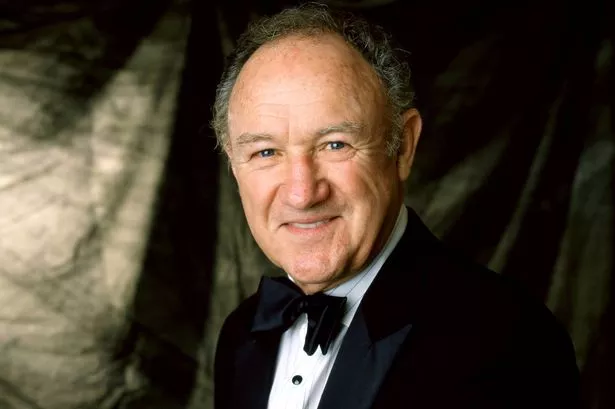

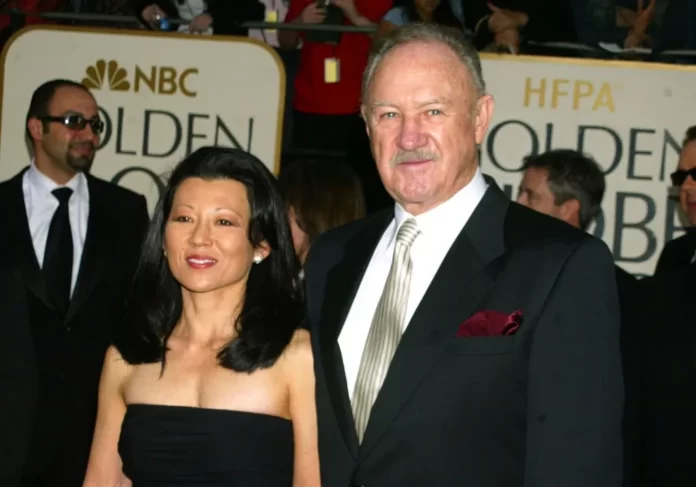

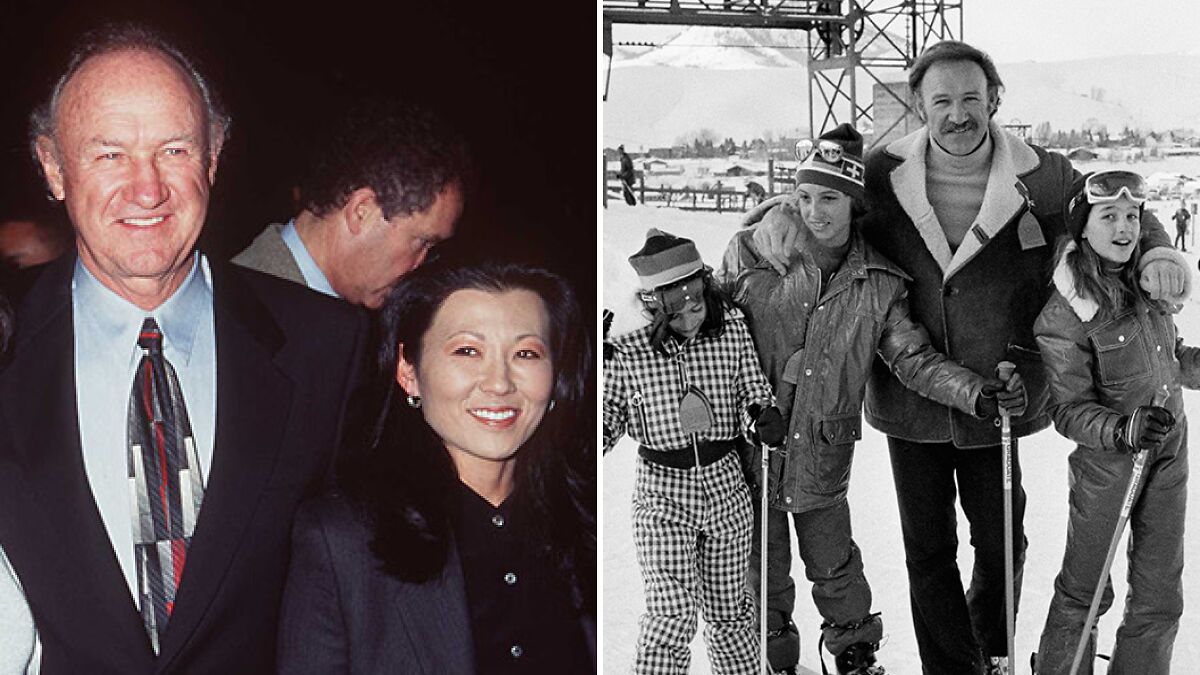

Gene Hackman, the legendary actor known for iconic roles in films like The French Connection and Bonnie and Clyde, passed away in early 2025, leaving behind an estimated $80 million fortune. Despite having a will, the details of who will inherit Hackman’s vast estate remain largely undisclosed to the public. This secrecy stems from the sophisticated estate planning tools Hackman and his late wife, Betsy Arakawa, employed, including a living trust and a pour-over will. These legal instruments are designed to manage and distribute assets privately, often shielding beneficiaries’ identities from public scrutiny.

Hackman’s death, closely following Arakawa’s passing due to a rare virus, has complicated the administration of his estate. While the couple’s wills have been reviewed by trusted sources, the trust documents remain confidential, and court orders related to the estate’s management are not publicly accessible. This has sparked widespread curiosity and speculation about the ultimate fate of Hackman’s fortune and who will benefit from it.

The Role of Living Trusts and Pour-Over Wills in Estate Privacy

To appreciate why Hackman’s inheritance details are so private, it’s important to understand the estate planning mechanisms involved. A living trust is a legal arrangement created during a person’s lifetime to hold and manage assets. It allows for the smooth transfer of property to beneficiaries without the need for probate, the often lengthy and public court process that oversees wills. Because trusts operate outside of probate, they offer a high degree of privacy and can continue managing assets long after the grantor’s death.

Hackman’s estate plan also included a pour-over will, a complementary document that ensures any assets not already transferred into the trust during his lifetime are “poured over” into the trust upon his death. This dual approach is a popular strategy among high-net-worth individuals to maintain control over asset distribution while minimizing public exposure and legal delays.

In Hackman’s case, the trust named his wife, Betsy Arakawa, as the third-party trustee responsible for managing the assets. However, her untimely death before Hackman disrupted these plans, forcing the court to appoint a new trustee. Unfortunately, the identity of this trustee and the trust’s beneficiaries remain confidential, leaving the public in the dark.

Who Might Inherit Gene Hackman’s $80M Fortune?

Although the trust documents are private, some information about potential beneficiaries has surfaced. Hackman had three children from his first marriage: Christopher, Elizabeth, and Leslie. While his will does not directly leave assets to his children or relatives, it does mention them, suggesting they could be beneficiaries under the trust. Arakawa, who had no children of her own, was designated as trustee but not a direct beneficiary.

Arakawa’s own will left most of her estate to Hackman’s trust, but only if he survived her by 90 days—a condition he did not meet. As a result, her estate was directed to establish a charitable trust aligned with the couple’s philanthropic interests, though no specific charities were named.

Reports indicate that Christopher Hackman has engaged legal counsel, fueling speculation about potential challenges to the estate’s distribution. Probate cases can be lengthy and complex, and it remains uncertain whether the public will ever learn the full details of the inheritance if disputes are settled privately.

Lessons from Gene Hackman’s Estate for Your Own Planning

Gene Hackman’s estate saga offers valuable insights for anyone considering how to manage and pass on their assets:

- Privacy through Living Trusts: Creating a living trust can protect your estate from the public exposure of probate. It streamlines asset management and allows for easier updates as life circumstances change, such as marriage, divorce, or the birth of children.

-

Plan for Contingencies: Life is unpredictable. Including backup plans in your trust—such as contingent beneficiaries and successor trustees—ensures your estate is managed according to your wishes even if primary beneficiaries or trustees predecease you.

-

Consider Family Dynamics: For blended families or stepfamilies, dividing an estate fairly can be challenging. Clear communication and detailed estate documents can help prevent disputes and ensure your loved ones are cared for as intended.

-

Update Your Estate Plan Regularly: Hackman’s estate plan was created years before his diagnosis with dementia. Regularly reviewing and updating your estate documents can help reflect your current wishes and circumstances.

Why Gene Hackman’s Estate Remains a Cautionary Tale

The uncertainty surrounding Hackman’s $80 million fortune highlights the complexities of estate planning for high-net-worth individuals. Even with careful planning, unexpected events—such as the near-simultaneous deaths of Hackman and Arakawa—can complicate the administration of an estate. The case underscores the importance of having flexible, well-structured plans that anticipate various scenarios.

Moreover, it reminds us that privacy in estate matters is a double-edged sword. While trusts protect beneficiaries’ identities, they can also fuel public speculation and family disputes when transparency is limited.

Conclusion

Gene Hackman’s estate remains a compelling example of the power and pitfalls of modern estate planning. His use of a living trust and pour-over will ensured privacy and control over his $80 million fortune, but unforeseen circumstances have left many questions unanswered about who will ultimately inherit his wealth. For anyone looking to secure their legacy and protect their loved ones, Hackman’s story offers crucial lessons: prioritize privacy, plan for contingencies, and keep your estate documents current.

If you want to safeguard your assets and ensure your wishes are honored, consider consulting an estate planning professional today. Don’t wait for uncertainty to cloud your legacy—start planning now to protect your family’s future.