Biden’s ‘Extravagant’ Pension is Largest of Any President in History – And Even More Than What He Earned as Prez

Understanding Biden’s Record-Breaking Presidential Pension

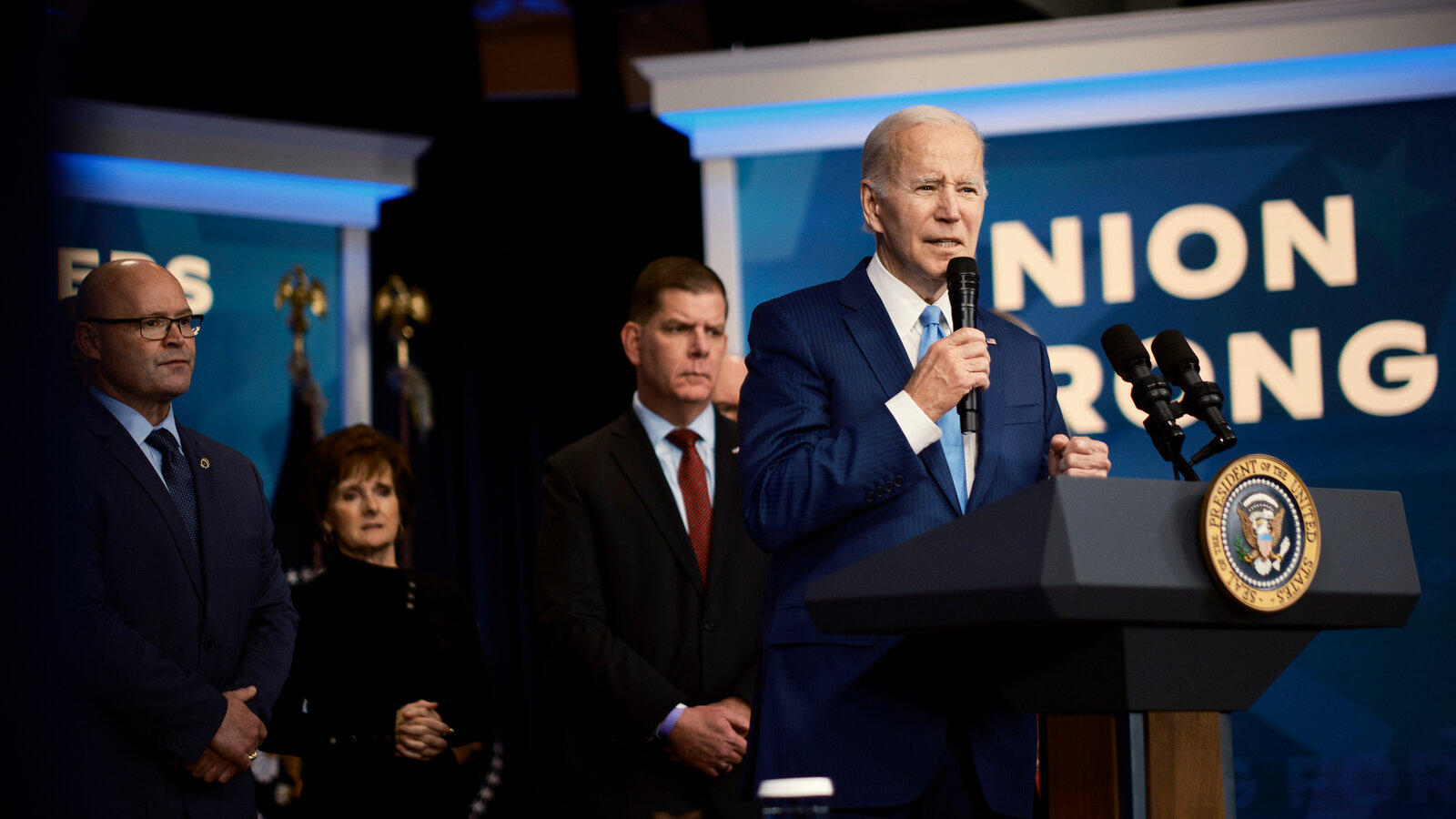

Former President Joe Biden’s retirement income has become a topic of national discussion due to its unprecedented size. According to experts, Biden’s annual pension of approximately $417,000 is the largest taxpayer-funded pension ever awarded to a U.S. president. Remarkably, this pension exceeds the $400,000 salary he earned while serving as president.

This extraordinary pension is the result of Biden’s unique and lengthy political career, which includes 44 years as a senator, eight years as vice president, and four years as president. His ability to collect from multiple taxpayer-backed retirement funds has led to what some describe as “double-dipping” in government pensions.

The Breakdown of Biden’s Pension Sources

Biden’s pension is derived from two primary sources: the Civil Service Retirement System (CSRS) and the Former Presidents Act (FPA) pension. The CSRS pension is based on his extensive service in the Senate and as vice president. This pension is calculated using a formula that considers his 44 years in public office and his highest three years of salary during that time. Experts estimate Biden’s CSRS pension to be around $166,374 annually, including a spousal benefit.

However, due to a cap that limits payouts to 80% of his highest salary, Biden’s CSRS pension is restricted to about $230,700 per year. This cap is tied to his highest salary as vice president and president of the Senate.

In addition to the CSRS pension, Biden receives a presidential pension under the Former Presidents Act. This pension is set to match the salary of a Cabinet secretary, currently $250,600 annually. The FPA was enacted in 1958 to provide financial support to former presidents, originally motivated by concerns over former President Harry Truman’s financial situation after leaving office.

Together, these pensions total approximately $417,000 per year, making Biden’s retirement income larger than any other former president’s and even surpassing his own presidential salary.

Additional Taxpayer-Funded Benefits for Biden

Beyond his pension, Biden also benefits from other taxpayer-funded perks. The General Services Administration (GSA) allocated over $1.5 million for Biden’s office expenses in fiscal year 2026, including $727,000 for office space alone. These benefits cover staff salaries, office equipment, travel expenses, and other support services provided to former presidents.

Unlike the pension, there is no cap on the amount of office space or rent that can be funded by taxpayers, which means these costs could increase depending on location and needs. These perks are provided for life, further adding to the overall taxpayer-funded benefits Biden receives.

The Debate Over Presidential Pensions and Calls for Reform

Biden’s “extravagant” pension has sparked debate among lawmakers, taxpayers, and political commentators. Critics argue that the current system allows former presidents to receive excessive taxpayer-funded benefits, especially when those benefits exceed the salary of the sitting president.

Demian Brady, Vice President of the National Taxpayer Union Foundation, described Biden’s pension as “historically unusual” and suggested that congressional reforms are necessary to prevent such large payouts in the future. Brady emphasized that while Biden’s situation is unique, it highlights loopholes in the pension system that could be exploited by future presidents.

In response to concerns about presidential pensions, legislation such as the Presidential Allowance Modernization Act has been introduced. This bill aims to cap presidential pensions at $200,000 annually and reduce or eliminate perks like office space, staff, and travel expenses. A similar bill passed Congress in 2016 but was vetoed by then-President Barack Obama, who would have been affected by the changes.

Broader Implications for Congressional and Political Pensions

The controversy surrounding Biden’s pension also shines a light on pensions for other federal officials. Every member of Congress qualifies for a pension after five years of service, with benefits paid out by taxpayers. These pensions collectively cost taxpayers approximately $38 million annually.

Some members of Congress have drawn criticism for timing their retirements to qualify for pensions quickly, as was the case with Rep. Marjorie Taylor Greene, who planned her departure to meet eligibility requirements for a modest pension. Meanwhile, long-serving members like former Speaker Nancy Pelosi are set to receive significantly larger pensions.

These issues have fueled ongoing discussions about pension reform for elected officials, with advocates calling for stricter limits and greater transparency to ensure taxpayer money is used responsibly.

Conclusion

Joe Biden’s record-breaking pension highlights the complexities and controversies surrounding taxpayer-funded retirement benefits for former presidents and elected officials. While his extensive career has earned him a unique financial position, it also raises important questions about fairness, government spending, and the need for pension reform.

As debates continue, it is crucial for citizens to stay informed and engage with policymakers about how public funds are allocated. If you want to learn more about presidential pensions and support efforts for transparency and reform, consider reaching out to your local representatives today. Your voice can help shape the future of government benefits and ensure accountability for taxpayer dollars.